property tax on leased car in ma

In the fifth and all succeeding years. Excise tax is assessed from the time the vehicle is registered at the RMV.

Who Pays The Personal Property Tax On A Leased Car

You can only drive so many miles each year in a leased car.

. June 4 2019 913 PM. Most companies set a limit of 12000-15000 miles every year. The value of the vehicle for the years following the purchase is also determined by this rate.

The vehicle excise tax deduction is a federal item and is specifically reported to the IRS on Form 1040 Schedule A Line 7 please see the attached image at. Additionally you can look up the business with the Better Business. Massachusetts Property Tax Information.

To find out about any complaints that have been filed with the Attorney Generals Office against the dealership you intend to buy or lease from visit the consumer complaint page on our website or contact the consumer hotline 617 727-8400. The fee amount ranges from about 250 to 800 much of which is simply added profit for the dealer. Get your bill in the mail before calling.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Property tax on leased car in ma. The minimum excise tax bill is 5.

Maine municipalities levy an annual motor vehicle excise tax on owned and leased vehicles for the privilege of operating a vehicle on the public ways me. Massachusetts enforces an excise tax each year for people who have vehicles registered in the state. Or you can lease a different car.

This may be a one-time annual payment or it may. Massachusetts collects a 625 state sales tax rate on the purchase of all vehicles. Like with any purchase the rules on when and how much sales tax youll pay.

In the fourth year. When you lease a car you dont have to worry about the car losing value. At the end of your lease you have the option to buy the car for a fee.

LIMITATIONS OF A LEASE. If the lease states that you are responsible for these taxes you will then receive a bill from the dealership. Property Tax On Leased Car In Ma.

To learn more see a full list of taxable and tax-exempt items. If you do pay the personal property tax you can deduct it. They are just different ways of financing.

This page describes the taxability of leases and rentals in Massachusetts including motor vehicles and tangible media property. If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year.

In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay. In Massachusetts you can deduct the Motor Vehicle Excise Tax you paid on your vehicles. Excise abatements are warranted when a vehicle is sold traded or donated within the year or has been registered in another state.

We send you a bill in the mail. This would apply whether you own or lease. Arkansas Connecticut Kentucky Massachusetts Missouri North Carolina Rhode Island Texas haha I always found it funny how when you flip the A and the E in Texas you get Taxes LOL Virginia West Virginia and.

If your vehicle isnt registered youll have to pay personal property taxes on it. The terms of the lease will decide the responsible party for personal property taxes. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment.

You wont see a special place to enter the vehicle excise tax deduction on your Massachusetts state return either in the TurboTax software or elsewhere because it simply does not exist. However the state has an effective vehicle tax rate of 26 according to a property tax report published earlier this year by WalletHub which calculated taxes on a. For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to.

A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles. You pay an excise instead of a personal property tax. In addition to taxes car purchases in Massachusetts may be subject to.

Sales tax is a part of buying and leasing cars in states that charge it. The excise tax is 25 for every 1000 of the vehicles value and is required to be paid in full. Youll have to.

The excise tax rate is 25 per 1000 of assessed value. While massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The state-wide tax rate is 025 per 1000.

For vehicles that are being rented or leased see see taxation of leases and rentals. How is Excise Tax determined for the state of Massachusetts.

Nbc 10 I Team Drivers Who Lease Cars Complain Of Double Tax Wjar

Who Pays The Personal Property Tax On A Leased Car

Nj Car Sales Tax Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Excise Tax What It Is How It S Calculated

Massachusetts Auto Sales Tax Everything You Need To Know

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

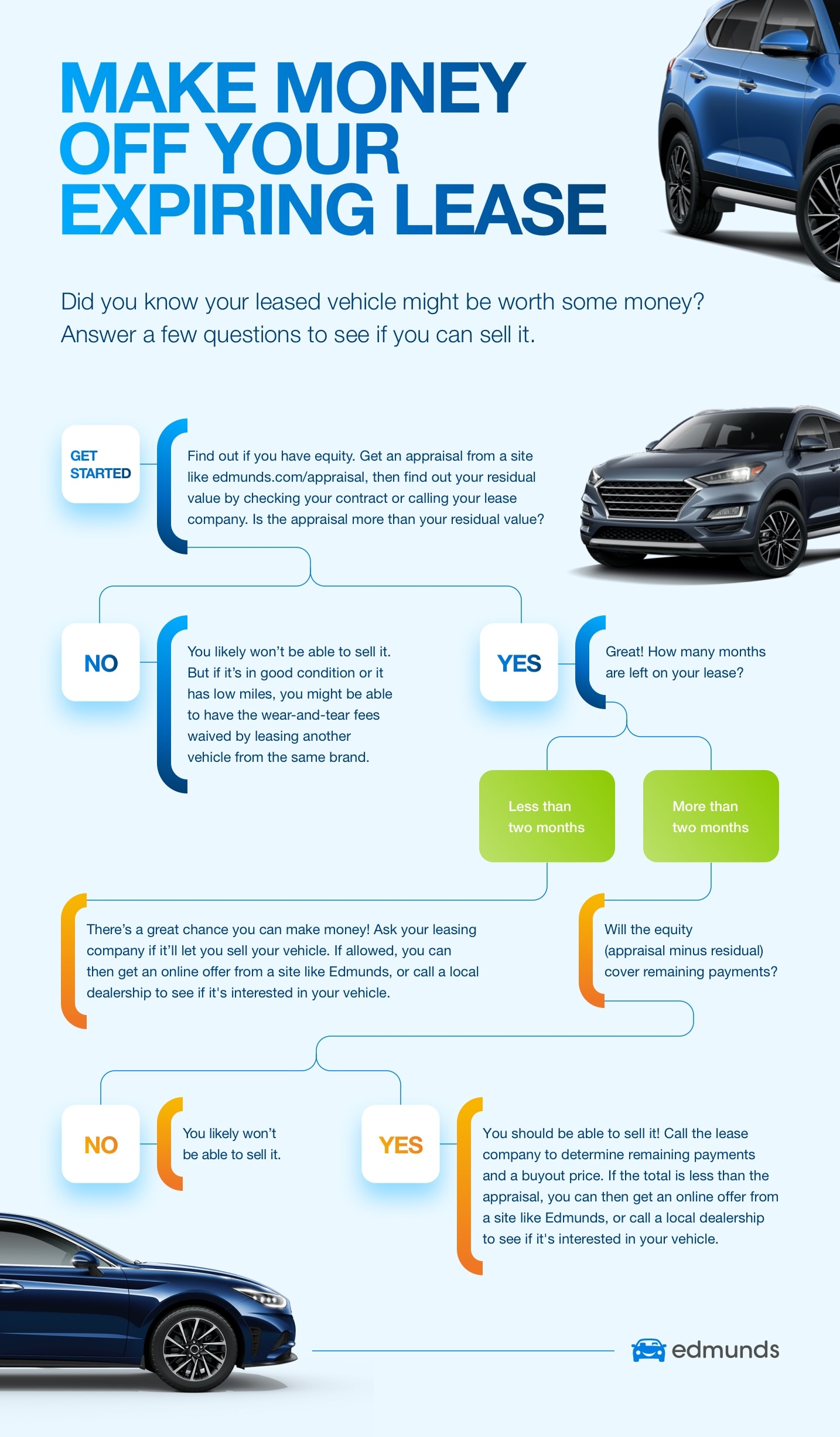

Consider Selling Your Car Before Your Lease Ends Edmunds

What S The Car Sales Tax In Each State Find The Best Car Price

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Who Pays The Personal Property Tax On A Leased Car

Are Car Repairs Tax Deductible H R Block

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

7 Eleven In Austin Tx For Sale 3 1m Commercialrealestate Assureserve Cre Realestate Invest Commercial Real Estate Investment Property Tax Free States